At a Glance

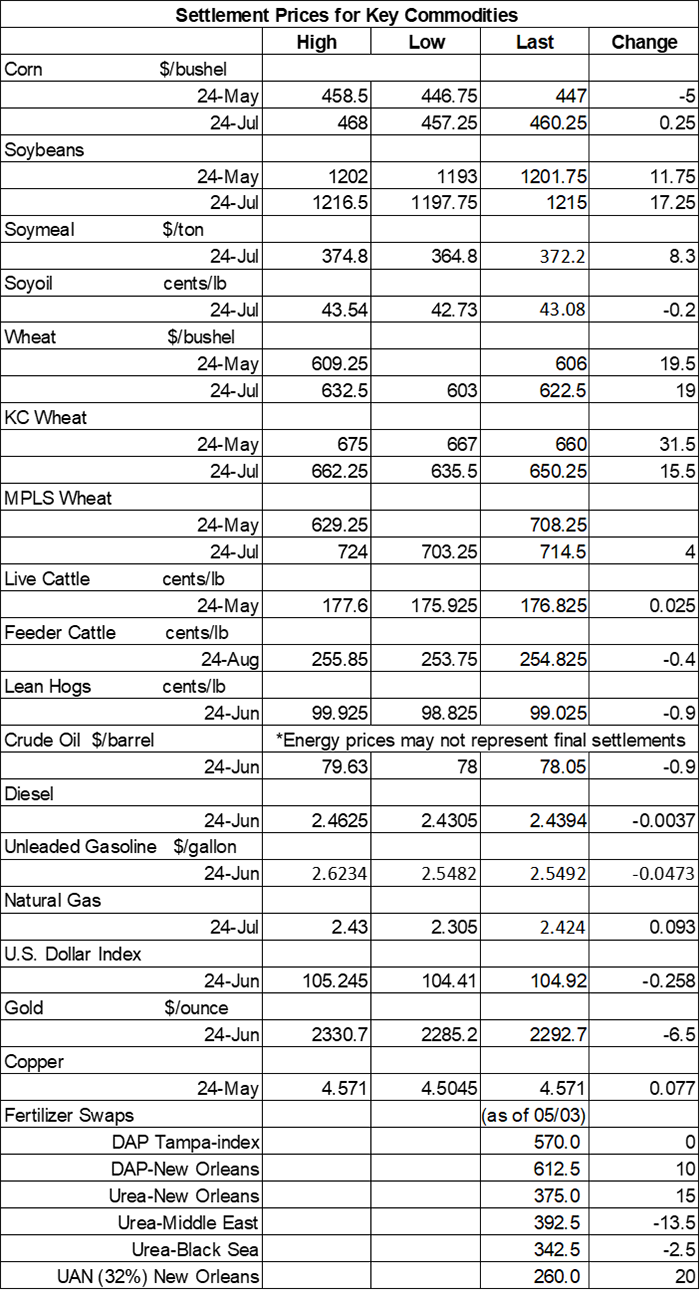

- Soybeans climb another 1% to 1.5% higher, with some wheat contracts jumping almost 5% higher

- July corn futures test fractional gains to close out the week

- Plus: Catch up on the “7 ag stories you can’t miss!”

Grain prices continued to push higher on news of flooding in Brazil, dry weather in Russia and rains in the U.S. that could lead to at least a few more planting delays. As a result, soybeans and winter wheat prices captured double digit gains, while spring wheat futures firmed 0.5%. Corn prices were mixed after some mixed technical maneuvering today.

At least some rain is likely for the entire Corn Belt between Saturday and Tuesday, with some fields bracing for as much as 1.5” or more during this time, per the latest 72-hour cumulative precipitation map from NOAA. Later on, NOAA’s new 8-to-14-day outlook predicts more seasonally wet weather for a large portion of the central U.S. between May 10 and May 16, with colder-than-normal temperatures creeping into parts of the Central Plains and western Corn Belt.

On Wall St., the Dow climbed another 454 points higher in afternoon trading to 38,680 after a worse-than-expected round of jobs data prompted some investors to expect the Federal Reserve to initiate interest rate cuts sooner than later. Nonfarm payrolls grew by 175,000 jobs in April, versus economist expectations of 240,000. Energy futures faded into the red, with crude oil spilling more than 1% lower to $78 per barrel. Diesel faced minor cuts of less than 0.25%, while gasoline stumbled 1.75% lower. The U.S. Dollar softened moderately.

On Thursday, commodity funds were net buyers of corn (+6,500), soybean (+12,000), soymeal (+7,000) and CBOT wheat (+3,500) contracts. Funds were roughly even when trading soyoil contracts yesterday.

Corn

Corn prices were pressured by seasonal planting pressure despite some expected delays, although spillover support from soybeans and wheat mostly limited losses. May futures dropped 5 cents to $4.47, while July futures inched 0.25 cents higher to $4.60.

Corn basis bids were steady to weak after spilling 2 to 4 cents lower across five Midwestern locations on Friday.

Congressional ag leaders and others are cautiously optimistic that a farm bill may be passed before its current extension expires later this year. Farm Progress policy editor Joshua Baethge took a closer look at various industry responses to the progress and policy suggestions that have been made so far – click here to learn more.

Poor weather and an infestation of leafhoppers (which vector stunting disease) has caused the Buenos Aires grains exchange to cut its estimates for the country’s current corn crop by more than 118 million bushels after offering a new projection of 1.831 billion bushels. That would be the lowest production total in seven years, if realized.

French farm office FranceAgriMer reported a big jump in the country’s corn planting progress, which moved from 26% completion a week ago up to 45% as of April 29. Progress is still substantially below the prior five-year average of 70%. France is Europe’s top grain producer.

Corn settlements on Thursday were for 386,842 contracts.

Soybeans

Soybean prices leapt forward on another round of technical buying as traders kept their focus on recent Brazilian flooding that could lead to substantial production losses in the state of Rio Grande do Sul. May futures rose 11.75 cents to $12.0175, while July futures climbed 17.25 cents to $12.1625.

The rest of the soy complex was mixed. July soymeal futures trended 2.25% higher, while July soyoil futures faded almost 0.5% lower.

Soybean basis bids were mostly steady across the central U.S. on Friday but did track 3 cents higher at an Ohio elevator and 5 cents lower at an Iowa processor today.

Private exporters announced the sale of 4.5 million bushels of soybeans for delivery to unknown destinations during the 2023/24 marketing year, which began September 1.

As another crop season kicks off, Farm Futures grain market analyst Jacqueline Holland is assembling a new batch of Feedback from the Field updates, which is populated with farmer comments from around the Heartland. Click this link to take the survey and share updates about your farm’s spring progress. Holland reviews and uploads results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country.

Severe flooding in Brazil’s No. 2 production state Rio Grande do Sul has left entire cities underwater and has devastated soybean production. Farm cooperative Cotrisal estimates that recent weather could lower total production by 10% to 15% in that state.

Soybean settlements on Thursday were for 291,449 contracts.

Wheat

Wheat prices firmed again on a round of technical buying that was partly spurred by dry weather in Russia, where very little rain is expected to fall for at least the next two weeks. July Chicago SRW futures climbed 19 cents to $6.2325, July Kansas City HRW futures rose 15.5 cents to $6.52, and July MGEX spring wheat futures added 4 cents to $7.1325.

Russian consultancy IKAR trimmed its forecast for the country’s current wheat crop to 3.417 billion bushels and also lowered its export estimates to 1.856 billion bushels. Russia is the world’s No. 1 wheat exporter.

French farm office FranceAgriMer reported that the 63% of the country’s soft wheat crop was rated in good-to-excellent condition through April 29, which was one point lower that week-ago quality ratings. It’s also substantially below 2023’s crop, when 93% was rated in good-to-excellent condition at this time last year.

Algeria has purchased as much as 11.0 million bushels of milling wheat from optional origins in an international tender that closed on Thursday. Russia and Ukraine were both likely sources. The grain is for shipment in July.

And finally, if you haven’t visited FarmFutures.com in a while, our Friday feature “7 ag stories you can’t miss is one easy way to quickly catch up on the industry’s top headlines. Today’s content includes a list of potential concerns farmers have regarding AI, a new rule that protects temporary farmworkers and more. Click here to get started.

CBOT wheat settlements on Thursday were for 101,642 contracts.

About the Author(s)

You May Also Like